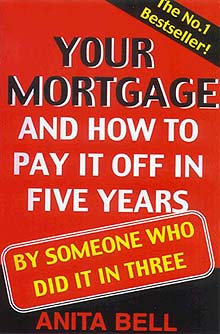

Your Mortgage

YOUR MORTGAGE AND HOW TO PAY IT OFF IN FIVE YEARS

Have you ever wondered how many decades it's going to take to pay off your mortgage? Does the idea of taking out a loan frighten you? Well take comfort in the fact that you are not alone.

If you are considering taking out a mortgage or already have one but would like to know how to pay it off faster, then Your Mortgage: And How To Pay It Off in Five Years, the new book by author Anita Bell, is the book for you!

Anita Bell guides readers through basic aspects of money management that all of us should know.

Learn about:

Motivation yours and theirs

The deposit

The contracts

Choosing the right loan

Loan application

Which house?

Paying off your mortgage 12 quick tricks

Budgeting

Sacrifice

Ready reckoners

The mystery of loan mechanics

A happy ending

With over 150,000 copies already sold, Your Mortgage has become the ultimate guide for homeowners of the present and the future. This updated edition contains detailed information on the First Home Buyers Scheme and the GST, a must read for anyone who is considering purchasing a new home or paying off their current one.

Nine years ago, Anita Bell, full time mother, successful businesswoman and author, paid off her first home in just 38 months!

In simple no-nonsense steps, Anita shows you how to save the deposit, how to secure the right loan, find the right house or flat, how to get it at the right price and how to make it all yours.

This book gives you all the practical help you need to own your own home outright sooner than you ever believed possible with Anita offering down-to-earth advice that really works.

The following is a Loan Checklist devised by Anita to ensure you select the loan that is best going to benefit and suit your needs.

LOAN CHECKLIST

Daily Reducing - cash payments must be deducted from the amount owing on the day you deposit them, or the next day if made by cheque.

It must be able to accept additional payments at any time whether for a fixed term loan or not.

All additional payments must reduce the principal immediately (not treat the principal and interest amounts separately; and not have extra payments held for any period.

It should have little or no early payout fee.

It should have no monthly or ongoing fees.

The moral of the story as advised by Anita is that daily reducing is more powerful than monthly reducing.

- Annemarie Failla

MORE