Ashley Gray Maths Anxiety Interview

Ashley Gray Maths Anxiety Interview

Westpac has released new insights from their 2017 Numeracy Study, revealing that one third of Australian children (34%) and adults (31%) experience feelings of -Maths Anxiety'. Furthermore, the study uncovered a quarter (24%) of Australian children don't think they are smart enough to do maths.

Amongst those adults who suffer from -Maths Anxiety', half (50%) never enjoyed maths at school and more than a third (36%) enjoyed it at first but eventually lost interest. Those who lost interest are more likely to have done so because they found it too difficult and couldn't keep up, or they didn't associate themselves with being a -maths person'. The survey also found half (51%) of Aussie Adults would feel challenged if asked to help with a year 10 student's maths homework.

Ashley Gray, Head of Youth and Millennial markets at Westpac, said the findings suggest that parents' own negative feelings towards maths could be trickling down to their children and impacting their confidence and performance.

'It's concerning that an equal portion of kids and adults experience -Maths Anxiety' due to fears they are not smart enough or find it too difficult. With many of the fastest growing jobs of the future requiring STEM skills, this anxiety and difficulty with maths could lead to issues with employment and job security for the next generation."

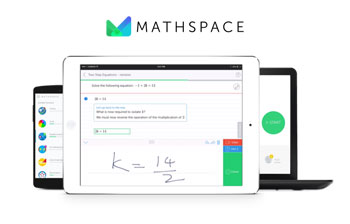

'Numeracy is also positively linked with financial literacy and strong financial futures. That's why we partnered with Mathspace earlier this year to offer free access to Mathspace Essentials for every Australian, further supporting the next generation with the skills they need for the future."

Westpac is also offering the -Solve to Save' program which gives students who subscribe to Mathspace Plus the opportunity to have the $10 weekly subscription fee deposited back into their Westpac account if they successfully complete their weekly maths exercises.

This initiative is supported by findings from the 2017 Westpac Numeracy study which found that three quarters (74%) of parents with school-aged kids are supportive of incentivising students to complete maths homework, and 9 in 10 Australian children say they could be financially incentivised to do their maths homework.

'The aim of Solve to Save is to encourage children to complete their maths exercises successfully, whilst encouraging positive savings habits from an early age and teaching them about the value of money," Mr. Gray from Westpac said.

Mathspace CEO and co-founder, Mohamad Jebara said everyone has the capacity to learn and love maths if they have the right tools to address their gaps in understanding and develop their self-confidence.

'Mathspace allows children to learn at their own pace. A subscription to Mathspace Plus offers a personal digital maths tutor with adaptive learning technology, designed to track your progress and give you a tailored maths program in real-time.

'Our hope is that Solve to Save will help to motivate children to study maths every single week. The regular $10 incentive will reward children's efforts in the short-term and build positive habits for the long-term," he said.

Since April this year, over 45,000 Australians have downloaded the Mathspace Essentials program for free thanks to Westpac, usually valued at $99.

For more information, and to access Mathspace, visit www.westpac.com.au/maths.

Interview with Ashley Gray, Head of Youth and Millennial Markets at Westpac

Interview with Ashley Gray, Head of Youth and Millennial Markets at Westpac

Question: What inspired the Westpac 2017 Numeracy Study?

Ashley Gray: We are interested to learn more about Australians' attitudes – including adult and children – towards their own competency in maths. As Australia's first bank and oldest company, we are committed to supporting the next generation of Australians and the future prosperity of our nation. We know that many skills of the future require STEM skills and so we are working towards creating more confidence and capability in maths.

Question: Can you share some of the findings from the Westpac 2017 Numeracy Study?

Ashley Gray: The 2017 Westpac Numeracy Study revealed that one third of Australian children (34%) and adults (31%) experience feelings of -Maths Anxiety'. Furthermore, the study uncovered a quarter (24%) of Australian children don't think they are smart enough to do maths.

Amongst those adults who suffer from -Maths Anxiety', half (50%) never enjoyed maths at school and more than a third (36%) enjoyed it at first but eventually lost interest. Those who lost interest are more likely to have done so because they found it too difficult and couldn't keep up, or they didn't associate themselves with being a -maths person'. The survey also found half (51%) of Aussie Adults would feel challenged if asked to help with a year 10 student's maths homework.

Question: What surprised you the most from the Westpac 2017 Numeracy Study?

Ashley Gray: That one third of Australian children and adults experience -Maths Anxiety' is both surprising and concerning. With many of the fastest growing jobs of the future requiring STEM skills, this anxiety and difficulty with maths could lead to issues with employment and job security for the next generation.

Question: What is -Maths Anxiety'?

Ashley Gray: -Maths Anxiety' is experienced by people who feel -confused', -anxious', -worried' and/or -scared' when asked how they feel about maths.

Question: How can we treat -Maths Anxiety'?

Question: Can you talk about the Westpac partnership with Mathspace?

Ashley Gray: We partnered with Mathspace, a market leading digital maths program, which provides step-by-step adaptive maths learning. The platform offers real-time feedback on a student's progress, as well as tailored guidance on how to calculate the answer. Through our partnership we sponsored Mathspace Essentials, making it available for free access to all Australians (normally valued at $99). Since we announced our partnership, almost 50,000 Australians have downloaded the program, highlighting the need for this type of learning and a desire to improve numeracy skills and self-confidence.

Question: What is Solve to Save?

Ashley Gray: Westpac has also launched the -Solve to Save' program which gives students who subscribe to Mathspace Plus the opportunity to have the $10 weekly fee deposited back into their Westpac Choice account if they successfully complete their weekly maths exercises. Mathspace Plus is like having a personal digital maths tutor, which tracks your progress to give you a tailored maths program in real-time.

Question: How important is teaching positive saving habits, from an early age?

Question: How important is teaching positive saving habits, from an early age? Ashley Gray: We feel it's very important for everyone to form regular habits of saving. If these can be instilled from an early age it will make it easier for children to understand their finances in later life, and help them set aside money for key moments in their lives, such as buying a house or preparing for retirement.

We know setting up a regular saving behaviour can help people feel more confident and in control of their finances and their future.

Question: What are your top saving tips for families?

Ashley Gray: Set goals and targets: the first step to a successful savings plan is knowing what you're saving for, how much you need to save and when you need to save it by.

Focus on quality rather than quantity: making smaller, regular saving deposits is better than irregular, large savings that might put a strain on your cash flow. It's not about how much you save, it's how often.

Prioritise your savings: setting aside your desire savings amount as soon as you receive your salary or pocket money in the first day of the month is a much better strategy than saving whatever in left in your account in the end of the month

Review your spending: chances are you'll find different ways where you can cut back and make thrifty purchase decisions.

Interview by Brooke Hunter

MORE