Money Accessories, Tips and Advice

Money Accessories, Tips and Advice

Are you tired of hearing that women are bad with money? We are. After working with women and their money for 20 years, Susan Jackson, founder of ms money.com.au knows that women can and want to make the most of their hard-earned cash. The thing is- they want to do it their way.Women and men have different approaches to money. Women attach different meanings to it. However, traditional financial service providers continue to ignore this reality. Rather than chastising women for shopping at the expense of saving, ms money believes you can have the shares and the shoes.

Successful money management for women is like sustainable, long-term weight management- the crash diets just don't work. Being told you have to stop shopping if you want financial security is like threatening to take chocolate away forever than the wondering why it's hard to stick to the plan.

Women like to buy tangible things; and they like solutions that fit into their busy lives. So why ignore what women need to make their money work for them?

The trick is managing money in a way that suits a women's communication needs, is practical and fits in with their busy lives. Susan used her 20 years experience as a financial planner to develop the ms money range of money accessories, advice and tips. Practical and attractive, they are tailor-made to help women manage the common hurdles that can de-rail their financial goals.

"ms money acts more like a girlfriend than a financial advisor," says Susan Jackson. "The accessories work with her daily life, understand her spending behaviour and the triggers that will lead to stress and disorganised finances."A unique range of money accessories: shopping cards, spending diaries, a piggy bank, money organiser and receipts folder are complemented by a website with financial tips and advice, social networking education groups and club, newsletters, and face-to-face events and seminars.

Tame the Spend Devil

Keep a leash on the Spend Devil in all of us with the ms money™ Spending Cards. She is the temptress of impulse-buys and sale excess. A barrier against wiping out the credit card for unplanned purchases, ms money™ Spending Cards are a practical way to keep a reminder in your wallet to buy only items on your list for the week or month. The cards can be attached, with a magnet, to the fridge for easy access.

$9.95

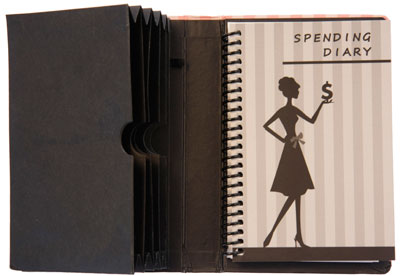

ms money™ Spending Diary

ms money™ Spending DiaryKnowledge is control. It's easy to forget 'invisible' purchases but all spending is spending. Compact with an expanding folder and receipt filing, the ms money™ Spending Diary helps women take control of spending by tracking where the dollars go. Once the spending pattern is transparent, the Diary helps you plan your spending so you can have the shoes and the shares. The diaries come in three colours; pink, yellow and blue, to ensure they fit perfectly into your life.

$24.95.

Adopt a Pig

It might start as a gold coin, but could lead to gold class investments. The old-fashioned piggy bank is an idea whose time has come again fro the financially savvy women. Give you ms money™ Adopt A Pig a name and feed it a diet of loose change and money saved from the clutches of the Spend Devil. Often our loose change from dinners, nights out or groceries is thrown into our bags and lost; now you have an adorable pig to drop your spare change into and save for something magnificent! Before long money that would have been spent unnecessarily will be ready and waiting for a higher purpose.$14.95

ms money™ Investment Club Starter Kit

Investment Clubs are a popular and successful way for women to take their first steps into investing. The benefits are many; sharing knowledge and expertise, reducing the amount of money you need personally to invest and making new friends. For those interested in starting an Investment Club, the ms money™ Investment Club Starter Kit contains step-by-step instructions to set up the club structure and roles, registration forms, sample partnerships agreements, tips, hunts and financial software and more. Get read to start clubbing!

$175.00

Get Organised

Get OrganisedShoe boxes are great for shoes but not for receipts. Getting organised is an important first step in taking control. No more lost receipts, tax-time stress or putting off sorting business or work related expenditure, medical expense and household or personal spending. The ms money™ Receipts Organiser is a compact (16.5 x 23 cm) notebook with 12 individual pockets for each months receipts to track expenses by type.

$17.95

Why Saving is like Dieting and Budgets don't work

Why Saving is like Dieting and Budgets don't work looks at the realities of money management and provides practical advice and strategies. Designed to help women understand their indicial money personality and behaviour and identify the system and strategies that are right for their needs.

Find out why budgeting is bad for you; understand your money persona; tame the spend devil, retrain disobedient credit cards, survive post-natal recession, or learn how to manage your finances as a couple. Why saving is like dieting and budgets don't work contains a wealth of tips and case studies.

$24.95

The Women's Guide to Property

The Women's Guide to Property is the essential guide for anyone planning to purchase, sell or invest in property. The user-friendly advice, handy hints, comprehensive glossary and step-by-step property purchase action plan will put you in control of your property acquisitions. Topics include finding the right property, is it better to rent or buy, working out how much you can afford to borrow, auction versus private sale and investment properties.

$24.95

ms money's™ Guide to the Global Financial Crisis

Complete with an overview of the recession, ms money's™ Guide to the Global Financial Crisis helps you identify what you can do to maximize your financial position as the economy recovers. Take control of the opportunities today by arming yourself with knowledge about global liquidity; the Great Stimulus; the role of consumer spending; signs of economic recovery; the good and bad times to invest; and the wealth creating opportunities of the current environment.

$17.00

Susan Jackson is a licensed financial planner and founder of ms money (2009) and the Women's Financial Network (1995). Author of The Women's Guide to Property, Why Saving is Like Dieting and Budgets Don't Work, and the ms money™ Guide to the Global Financial Crisis. Susan is one of Australia's leading experts in women and finance.

Over the past 20 years Susan has developed a deep understanding of the financial needs of women and applied this insight to the development of ms money accessories and advice. Ignoring short-term 'pink marketing' tactics, Susan's approach is underpinned by ongoing dialogue with women about their financial plans and needs.

As an advocate for improving women's financial position, Susan has developed a range of financial literacy programs, used by several government bodies. In particular, working with the Victorian State Government and the Victorian Council for the Ageing, Susan developed a program to increase women's retirement savings, resulting in a $1m state grant towards financial literacy programs for women.

Susan is a sought-after public speaker and regular media commentator.

Money accessories, tips and advice are available at www.msmoney.com.au

MORE